Can’t decide between free checking, dividend checking, cash back checking, or any other option. You don’t have to! We’ve combined all of your favorites into one great Checking Account!1

✔ |

✔ |

✔ |

✔ |

.tmb-medium.jpg?Culture=en&sfvrsn=5df5a25f_1)

✔ |

✔ |

✔ |

✔ |

Truly Free Checking

| Best For | The Johns Hopkins FCU free rewards checking account is best for someone who wants a free checking account that also offers rewards. |

| Monthly Fee | $0 |

| Opening Deposit | $0 |

| Minimum Balance | $0 |

| Earn Dividends | Dividends paid on all balances at competitive rates |

| E-Services | Free Online and Mobile Banking, Check DeposZip®5, Bill Pay, and MoneyMap. |

| ATM Use | Free Visa® Debit Card with surcharge-free access to over 30,000 ATMs nationwide. |

Why split up the best features and make you choose? JHFCU’s checking has all the best features wrapped up in one account.

★★★★★

“I love this credit union! They are very prompt with handling any questions or concerns and really put your needs first. The products they offer are top notch as well! Every time I go to one of the branches the staff is always very helpful and friendly! I am a member for life :)”

- Kristen F.

How To Apply

If you are already a member of JHFCU and would like to open a checking account you can do one of the following:

- Log into your account:

- Click "Accounts" from the menu

- Select "Open Checking Account"

- Print and submit a Checking & ATM/Debit Cards Application.

If you are not already a member of JHFCU and would like to open an account, please complete our online application.

You will be asked to provide the following:

- Copy of your work badge or proof of eligibility.

- Copy of valid government-issued ID or passport.

- $25 minimum deposit for savings.

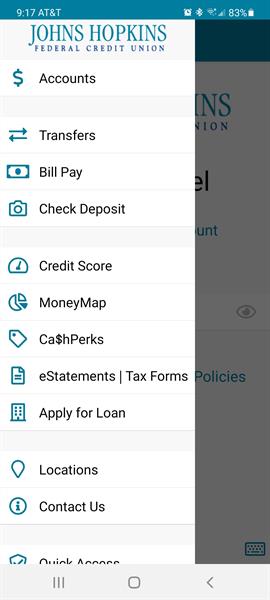

Easy & Secure Mobile Banking App

✔Deposit checks

✔

Check your credit score

✔ 24/7 Account Access

✔

View account activity & balance(s)

✔ Locate a branch or ATM

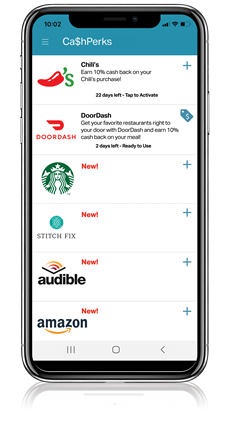

No coupons to print, points to redeem, or loyalty cards to manage!

Start earning cash back (from a few cents to over $100) on select JHFCU Visa debit transactions. All you need is JHFCU’s Visa Debit Card and Online Banking to participate.

Here’s How To Earn Ca$hPerks On Select Debit Card Transactions

1. CLICK to active offers

2. SHOP at local merchants

3. EARN CASH BACK!

You will be automatically enrolled in the program once you have your JHFCU debit card and enroll in online or mobile banking. To learn more, visit our online & mobile banking page.

1 Checking available to members age 16 and older; some restrictions apply.

2 Each offer comes with terms and limitations. Minimum purchase may be required; see offer for details. Some retailers limit the amount per offer, but there is no limit on the total amount you can earn from multiple offers. Cash back will be credited to your account the last day of the following month from which it was earned (e.g., cash back earned on purchases made in July will be credit the last business day in August). To opt out, simply click “Stop Receiving Offers.”

3 Subject to loan approval

4 First book free; free book every year with E-Statements, Bill Pay, and Visa Debit Card.

5 Must meet eligibility requirements.